4 Retirement Plan Options for Self Employed

- Many self-employed professionals worry about the difficulty and unpredictability of retirement planning.

- A traditional career offers built-in retirement plans, but options are different when you work independently.

- Your personal objectives and income level will be important factors when reviewing retirement options.

Self-employed professionals enjoy the flexibility, control, and creativity an independent career offers, but the challenge and uncertainty of planning for retirement is a common concern. At a traditional job, you have the benefit of built-in retirement options, but this field can be more difficult to navigate on your own.

Fortunately, there are several solutions available. The right one for you will depend on a number of factors including your personal goals and income level, which you can discuss with a financial advisor.

4 Retirement Plan Options for Self-Employed Professionals

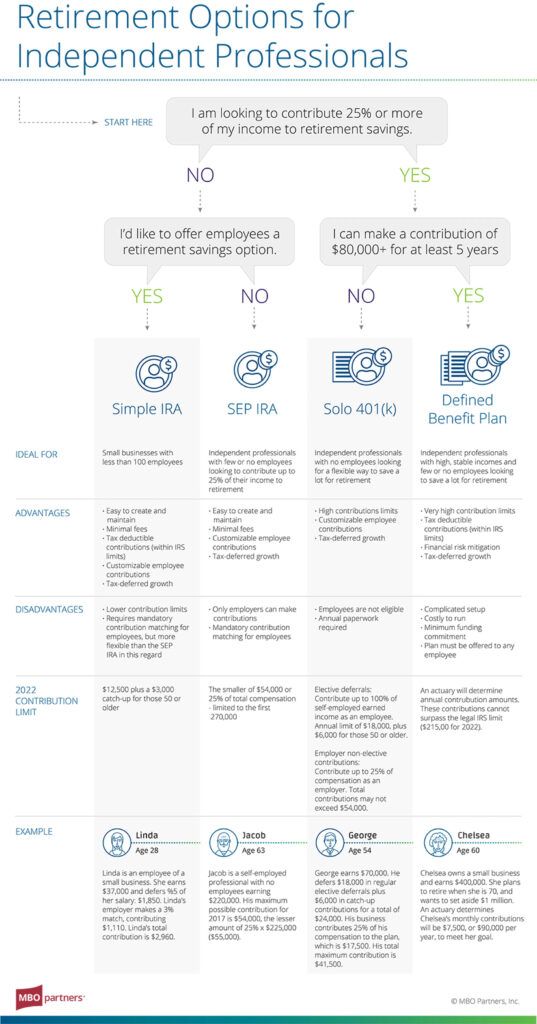

The decision on which plan you choose ultimately depends on whether you can contribute 25% or more of your income to retirement savings.

If the answer is no, you have two options for offering employees a retirement savings option:

1. Simple IRA:

This is ideal for small businesses with less than 100 employees and has several advantages:

- Easy to create and maintain

- Minimal fees

- Tax-deductible contributions

- Customizable employee contributions

- Tax-deferred growth

2. SEP IRA:

This is great for independent professionals with few or no employees looking to contribute up to 25% of their income to retirement. Advantages are:

- Easy to create and maintain

- Minimal fees

- Customizable employee contributions

- Tax-deferred growth

If you can contribute 25% or more of your income to retirement savings, your best options are a Solo 401(k) or a Defined Benefit Plan.

3. Solo 401(K):

This is ideal for independent professionals with no employees looking for a flexible way to save a lot for retirement. Advantages are:

- High contributions limits

- Customizable employee contributions

- Tax-deferred growth

4. Defined Benefit Plan:

This is a great option for independents with high, stable incomes and few or no employees, looking to save a lot for retirement. Advantages are:

- Very high contributions limits

- Tax-deductible contributions

- Financial risk mitigation

- Tax-deferred growth

Here is a summary of the retirement options available to self-employed professionals. Answer the questions in the infographic below to discover which one is best for you.

Categories

Subscribe to the Insights blog to get weekly insights on the next way of working

Join our marketplace to search for consulting projects with top companies

Learn more about MBO

Learn how to start, run and grow your business with expert insights from MBO Partners

Learn how to find, manage and retain top-tier independent talent for your independent workforce.

MBO Partners publishes influential reports, cited by government and other major media outlets.

Research and tools designed to uncover insights and develop groundbreaking solutions.