How Much Should I Charge As a Consultant? (Guide)

Whether you’re preparing to land your first consulting project or are already well along on your journey, you have most likely considered how much to charge for your services. While there’s no one-size-fits-all answer, there are a few reliable methods to help you determine your ideal bill rate.

GATE

There are three basic strategies to find your ideal bill rate: cost-based, market-based, and value-based. You can also have a blended rate that combines elements of each.

Bill rate (n.): the amount a company or professional charges per hour of work.

1. Cost-Based Rates

STEP 1: CALCULATE YOUR COSTS

Costs consist of labor, taxes and benefits and overhead costs; these can also be known as fixed vs. variable costs.

Labor costs

Instead of considering just salary (that is, how much you are currently paid as a full-time employee for your work), you must instead consider the cost of your services or the labor cost in the open market. A good way to determine this is to ask: If you were to hire someone, how much would you have to pay to do this project?

You can start by benchmarking salaries offered to you or others for similar work. Just remember: The salary is not what you want to earn but what you would be paying someone else for the work you are doing. If the work is required to be done at a particular location, then factor in salaries for that local market.

Benchmark salaries for an idea of what is offered to you or others for similar work. Just keep in mind that salary and hourly rates don’t always equate.

Use these websites (and similar ones) for research:

- Glassdoor.com

- Salary.com

- Payscale.com

Taxes and benefits

Once you have your labor cost, now add on all the benefits that are generally required or expected of an employer such as employer payroll taxes (the employer’s share of Social Security tax and Medicare), workers compensation insurance, unemployment insurance, and contributions to health insurance and retirement savings.

As a self-employed professional, you will be responsible for securing your own health insurance and setting up your own retirement plan. You are also required to fund both the employers and the employee’s share of Social Security and Medicare Taxes (also known as Self-Employment Tax). Many clients will also require insurance such as worker’s compensation or other professional business insurance specific to your industry.

Don’t skimp here for the sake of lowering your costs, as these are fixed-cost items that, even with proper deductions and tax benefits, can’t be eliminated.

When estimating the cost of these payroll related taxes and benefits, it’s generally a good idea to factor in an additional 30-35% of your labor cost, more if you want to contribute significantly to your retirement.

Don’t forget overhead costs! Your overhead are costs that you incur to manage and grow your business. These costs can’t be directly tied to the services being delivered and thus generally don’t get invoiced to your clients.

While most overhead costs can be accounted for by simply making an informed assessment, or even an educated guess, others may be more unfamiliar if you’re branching out on your own for the first time.

Overhead can be a vast and varied list of items that include office supplies, computer systems, marketing, training, and licensing fees. As each consulting practice varies, you should carefully consider the things you need to run your business that you can’t charge back directly to your clients.

Some costs to consider: subscriptions, advertising, trade shows, general liability insurance, professional liability insurance, books, training courses, website development, legal advice, tax advice, printing, travel costs for business development, etc.

It’s worth your while to be as thorough and detailed as you can when itemizing your overhead costs. Don’t omit anything that you use or plan to use for your business.

Tax deductible expenses

Getting down to the details can be worth it at tax time. Self-employed individuals can deduct many expenses used to run a qualified business, including home offices, car leases, and office equipment and supplies. However, these expenses are not guaranteed, and the IRS has specific rules for the way in which these materials must be accounted for and declared.

Depending on the scope and volume of your business, it may even be worthwhile to hire a tax professional, although this will add to your costs.

A better choice may be to outsource tax and expense management to a company such as MBO Partners that specializes in these matters, saving you billable time and money that you can invest into your business. Whichever way you choose, make sure you are getting the most benefit for incurred business expenses.

STEP 2: CALCULATE YOUR BILLABLE TIME

In building your hourly billing rate, you can—and should—calculate your utilization, a number that considers how many hours you are actually billing as a function of how many hours you have available for work.

Typically, the largest consulting firms target a utilization rate of 70% to 80%. The remaining 20% to 30% is used for business development, business administration, professional development, holidays, and personal time off.

Let’s now figure out the number of billable hours you have in a year, assuming 100% utilization. A standard used in the industry is 52 weeks x 40 hours a week = 2,080 available hours. Because no one can work every hour of every day of the year, start backing away from this number until you reach a figure that is reasonable.

Be generous to yourself and allocate the time you need to recharge, reboot, and revitalize. Remember, many people choose self-employment for its greater work–life flexibility, so build that time into your rate. When you have arrived at your own total number of available hours, you are halfway to achieving optimal utilization.

Not all your available time can be billed to clients. Now, determine the number of hours required to support your business on a non-billable basis. This includes time spent on new business development, training, and business administration. The amount of non-billable time you should allocate depends on your efficiency, skills, and infrastructure.

Bottom line: You should know the effort required and make it personal—figure out which parts are easy for you, and which are a true burden. Don’t rush to estimate this line. Depending on the value of your own billable hours, it’s often smart to outsource those items that are draining billable time and could be better performed by others, but don’t forget to account for that in costs. When you’re ready, input the percentage of hours you can bill of the hours you can work.

Conduct your own “reasonability test” when you set your utilization goals. The lower the number of billable hours, the higher the burden on your rate to meet a breakeven point. Lower costs help when utilization hours are low.

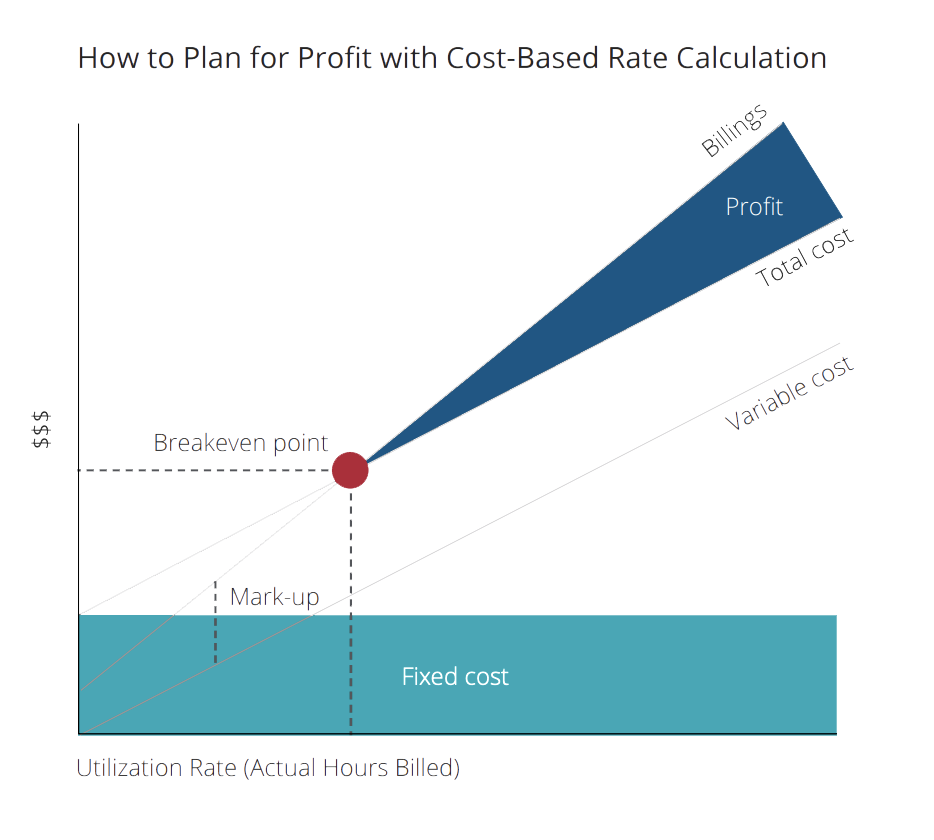

STEP 3: FACTOR IN PROFITS AND LOSSES

At this stage, you should have calculated—or will understand how to calculate—your bill rate cost, or the point at which your bill rate can begin to turn a profit.

Let’s find this:

- Calculate your total costs (labor, benefits, and overhead).

- Now, divide this number by the estimated number of billable hours. Your total represents the hours you plan to work multiplied by your utilization rate.

- This is your hourly bill rate cost just to break even. However, you’re in business to make a profit. You’ve taken a risk in becoming an independent contractor and you need to be rewarded for it. In addition to your bill rate cost, your final hourly bill rate is a function of cost plus a supportable profit markup.

Your risk comes from the possibility that you may not be able to bill all the hours you plan, incur higher costs than you planned, or face a client that does not pay their bills. If you’ve accurately accounted for all your costs and forecasted your billable hours and utilization, a reasonable profit could be 20–30%—your markup.

Markup: A percentage that you add to your cost to cover your risk to generate a profit. In other words, how much can you demand for your service beyond the bill rate cost?

How to manage loss

If your costs are not totally accounted for, and your utilization may end up being lower than you planned, you should factor in a higher markup. This provides you with a safety cushion, but it may also result in a cost-based bill rate higher than the market will pay. The higher your risk, the more you should factor in a higher markup. The more experienced you are, and the more informed you are, the more accurate your costs and utilization estimates will be.

As an independent consultant, you’ll likely experience the classic “feast or famine” cycle. Some famines will be natural, such as the downtime as you seek clients and solicit more work, and others will be man-made. When starting out, you may need to discount your rates just to get their foot in the door, build references, or gain experience with new projects. Be strategic when discounting your bill rate by clearly stating both your actual bill rate and the discounted rate for that particular project. This approach allows you to revert to your original figures upon project completion without needing to explain why your rates have “gone up.” They’ve just gone back to what your expertise and time are worth.

The greater the number of unknowns, the higher your mark-up should be…generally higher than 30%.

Due to the ups and downs of consulting life, profit is something you can plan for, but only really know after the fact. Profit is a function of your estimated costs, your estimated income, and how those play out over time—usually on an annual or quarterly basis. A simple way to think about it is this: It’s the amount left over.

Profits should be measured in the ability to meet your costs and have something left over to achieve your life goals.

A 10–15% profit range is common and a good place for an independent consultant to start and then eventually move up to 20–30%. Profit is one number you can—and should—consider in absolute terms. Like a target salary, you should have a target profit you wish to achieve. This is the amount you know will give you the ability to live to your desired standard, work the way you would like, and enjoy the things that drive you to earn an income. Similar to a business trying to hit quarterly numbers, it’s wise to plan a cushion for the cycles of profit and loss.

The cost-based method shines a spotlight on the needs of your business, not just the requirements of the market. Cost-based calculation is an inward approach that is critical in establishing parameters for your business.

To price yourself into a new market, or to compete with a higher-cost provider, you may consider two ways to use blended rates to your advantage:

- Offer a low hourly rate but include a bonus for reaching key milestones. This can help get your foot in the door by initially charging your client below market-average rates on an hourly basis. When you reach a key milestone, the client agrees to pay a milestone-based bonus.

- Blend team rates into a single client rate. Rather than bill each client individually at their respective rates, you can lead the team and the client relationship by proposing an average hourly rate.

This is a convenient way for you to come up with a single fee to present to the client.

2. Market-Based Rates

The first portion of this guide covered the cost-based method of bill rate calculation, providing consultants with a thorough breakdown of a consulting business’s cost components. The resulting bill rate reflected the amount you need to charge in order to cover your costs and earn a reasonable profit.

In a market-based approach, you’ll learn how to benchmark your internal cost-based rate against external conditions to stay competitive. Whether or not you share your market intelligence with your customer, understanding this rate can help you stand out from other providers and align with higher value firms in your industry. Market-based rates consider your sector and its competitive landscape at a specific point in time. To establish this rate, you will need to define the work you perform, evaluate similar services in the marketplace, and determine what clients who purchase those types of services are paying. In essence, you are determining what the market is willing to pay for your services.

STEP 1: DEFINE WHAT YOU DO

It’s common to fall into the trap of defining what you do by your job title (for example, Director of Marketing). While job titles may be good points of reference, they aren’t true definitions of the services you provide. Think of yourself not as a person comparing what you do to a salaried role, but rather a business serving a specific audience.

Establish your personal market-based skills definition by asking:

- What services do I provide, or wish to provide?

For example: Marketing consulting

- Then ask yourself: Is there a specific sub-set of consulting I am specialized in?

For example: Brand positioning consulting within marketing

- Consider the audience you wish to provide the service to:

For example: Fortune 100 firms or growing midsize firms (each has its own buying power and assumed price points)

Also consider the buyer:

- For example: Which department are you selling to? (Are you selling this to the C-suite or to a midlevel manager?)

- Who else would provide this service? If you were a marketing consultant specializing in brand positioning, would you be competing with a marketing firm or boutique agency?

STEP 2: APPLY MARKET INTELLIGENCE

Now it’s time to do some competitive research.

Talk to others in your industry, including consulting companies and even your current clients. They might be willing to share what they have paid in the past or are currently paying for similar services. When it comes to inquiring about your current clients, it will be easiest to pose these questions in the sales process: “What is your budget?” or “What are your expectations of what you would normally pay?” are two good probing questions to help establish their market price assumptions. Also, you might consider connecting with professional associations and networking with other independent consultants in your field.

Rates don’t have to be a specific number. Your research is meant to help you determine a range of rates.

What if I find that others are charging a fixed cost?

Many of your competitors may be using advantaged pricing techniques that allow them to charge a fixed price to the client while managing internal costs to create profitability. You may choose a similar approach if you can package your services with predictable costs. But for comparative purposes, you’ll have to estimate the amount of time your competitors assume to take to complete a task. This will help you derive a rate from the fixed project price you uncover through market intelligence. After comparing a few different cases and networking with other consultants and clients, you should develop a good idea of the time commitment required for project deliverables.

STEP 3: COMPARE MARKET-BASED RATES TO YOUR COST-BASED RATE

Have you already established a cost-based rate? If not, we recommend that you do so. By comparing it to the market, you can determine whether your market analysis results in a boom or a bust. Many consultants find that their cost-based bill rate can become the floor (the minimum they can charge to cover the cost of providing their service). However, sometimes the cost-based bill rate is higher than the market rate. This could be for any number of reasons:

- Your costs are higher than other competitors in the market (Are they working from more cost-effective contracts?]

- You’re working fewer hours or have lower utilization than others because you need more time to run the back-office or non-billable part of your business (Can you outsource some of these responsibilities?)

- You’re dedicating more time to business development, which can be more challenging when you have a customer that is hard to reach or takes a long time to make decisions (Is there a way someone can help you develop business, either via a referral partnership or by paying for support?)

If the market appears to be priced under your cost-based rate, this is the time to reassess and recalibrate to lower costs. A few simple steps you can take include trading rented office space with a home office and bundling your telecommunication needs to be more cost effective.

STEP 4: TAKE IT TO THE NEXT LEVEL: OPTIMIZE YOUR MARKETING POSITIONING

Big-name brands and indie shops alike spend significant time and effort on marketing and branding—and independent contractors must do the same. You’re not just selling your expertise, but you’re also selling yourself to the client. It’s important to “build your brand” and get client buy-in on your skills and expertise along withyour ability to develop long-term, sustainable relationships.

Branding and marketing:

- Build your brand. It’s essential to brand yourself in your subject area of expertise and demonstrate leadership and credibility. While you may not be a household name in your field just yet, start building a reputation so that your name evokes a strong association with your area of expertise. The more specific and “ownable” your expertise, the better you can stand out.

- Demonstrate how your thought leadership will bring something to the table that will creates value for your client. Does your project allow you to employ strategies that will give the client something that they didn’t have before or didn’t even know they needed?

Take every opportunity to effectively showcase your skills. A client will be willing to pay for experience that they don’t have and that you own. Good references, a solid track record, and great customer service will help attract and retain clients. They may also allow you to charge above the market rate as they believe they’ll be getting added value from hiring you as an independent consultant.

Use proximity to your advantage

Your client has the option of choosing any number of providers, some of whom may be located far away. Likewise, you may be pitching for business that is not right at your doorstep. Regardless of their business size or location, every potential client values providers who are strong communicators, project managers, and collaborators.

Demonstrate that you can deliver the work more effectively, either because you have past successful experiences, or you’re better suited to complete the work with less supervision compared to a lower-cost alternative. Remember: Location is only a disadvantage if you make it so. Consider the true value of your work and time when comparing your rate to another professional’s.

As a Java developer, you might look at offshore rates and be disheartened, but instead compare yourself to a manager guiding a group of offshore developers and interfacing with the client. Your rate is a function of your skills and your capacity for performing them independently, without assumed supervision. Don’t forget to charge for the entirety of what you do.

3. Value-Based Rates

Value-based pricing is the most advanced method for selecting a bill rate. In this portion of the guide, we’ll walk through the steps for determining a value-based approach to pricing and how it connects back to cost-based analysis and market validation. You’ll learn specific ways for setting a value-based rate, complete with examples that illustrate each rate scenario.

Use this method if:

- The scope of the project is clearly defined.

- The solution you are providing has a proven track record of success.

- You can demonstrate a strong ROI for your services.

- You have a direct relationship with the economic buyer on the project.

Avoid this method if:

- You’re new to consulting.

- There is low commitment from the Economic Buyer, or you don’t have a direct relationship.

- You aren’t confident in how much effort is involved in delivering the solution.

If you’re an independent consultant who can clearly identify the project, understand the client’s objectives, establish the metric that will indicate progress in improving the client’s condition, and ultimately demonstrate that value you’re well on the way to charging a value-based rate. If you possess unique intellectual property (IP), processes, skills, expertise, or methodologies that can create value for qualified clients, you are now ready and able to step away from the traditional models of time-based bill rates. Instead, you can charge your fees based on the “value” your services create for your clients.

This is perhaps the only instance where expertise—not time—is of the essence. Rather than simply being a transactional or deliverable-based resource to the client, value-based consulting pricing positions you as a strategic partner, engaging with your client in a consultative manner. The client may require an outside expert to step in to frame, guide, and solve a specific business problem. Or, they might need assistance in entering a new market, building a new product, creating a new methodology, or salvaging a business process gone wrong. Think of it as not just getting a rate per hour, but about gaining a true “piece of the action.” However, if you are unable to deliver, or if it takes a lot more effort than you bargained for, you also will have your share of the loss.

STEP 1: ASSESS READINESS—FOR YOU AND YOUR CLIENT

Value-based projects often emerge when a consultant listens intently, truly understands a client’s motivation and needs, and identifies areas where their specific skills can help the client save money, increase revenue, accelerate productivity, and much more. Value-based pricing is effective when the results add measurably to the client’s bottom line or top line. Are you ready to price for value? Take a good, long look at your competencies and assets. In order to successfully employ value-based pricing, you must have three things:

- Clearly understand the value your service will bring to your client and be prepared to communicate that value effectively. This means not just being good at what you do but also to being skilled at selling your skills in a persuasive and compelling way. You’ll need to mine your past projects for results and success stories that demonstrate your abilities along with the value you create. With trusted data, you can demonstrate that your services will most likely prove similar breakthrough results. You must show that you have done it before.

- Be a networking superstar. You must have an accessible network of clients with similar business problems that you can solve. Are you able to approach a manager, director, or even CEO, and share a point of view on the issues that trouble them? Which areas do buyers tend to look to you for advice?

If you’re a good communicator and can demonstrate to a client that they will see increased value or benefits because of your services, and if you know some clients personally, your “sell” should be easy. Plus, because you are positioning yourself to solve a problem, you are taking much of the burden of risk off your client. They are paying you for solving a problem, not for your time.

STEP 2: HOW TO SET A VALUE-BASED RATE

In traditional pricing methods, the client bears the risk by paying you for services based on a statement of work of assumed time and delivery. However, with the value-based method, the traditional model of the contractor/client relationship shifts to a collaborative one where you both share in the risks and rewards. Value-based pricing prioritizes results over time, and so the risk must be a measured one. Are you confident you can deliver on solving the business problem and show the results of your efforts? If so, you can set a value-based fee for your services.

4. Blended Rates

To price yourself into a new market, or to compete with a higher-cost provider, you may consider two ways to use blended rates to your advantage:

- Offer a low hourly rate, but include a bonus award for reaching key milestones. You may choose to get in the door by charging your client below market-average rates on an hourly basis. However, when you reach a key milestone, the client agrees to pay a milestone-based bonus, a point at which you recover the discount on your rate for a successful delivery of part of the project.

- Blend team rates into a single client rate. Rather than bill for each of them individually at their respective rates, you can lead the team and the client relationship by proposing an average hourly rate.

This is an easy and convenient way for you to come up with a single fee to present to the client.

MBO Partners can help easily manage paying a team working at different rates under a lead broker or consultant to reduce the time burden and help you enjoy the profits of this approach.

In this guide

Subscribe to the Insights blog to get weekly insights on the next way of working

Join our marketplace to search for consulting projects with top companies

Related posts

Learn more about MBO

Learn how to start, run and grow your business with expert insights from MBO Partners

Learn how to find, manage and retain top independent contractors for your projects.

MBO Partners publishes influential reports, cited by government and other major media outlets.

Research and tools designed to uncover insights and develop groundbreaking solutions.