3 ways to Manage Freelancers and Independent Contractors (Guide)

The demand for independent professional talent is continuing to grow year over year—72.7 million Americans work independently according to our latest research. As a result, businesses are actively seeking ways to find, engage, and retain relationships with these professionals. At the same time, they must also evaluate their contingent workforce management programs holistically to ensure they are truly meeting their core objectives. These include reducing the amount of time enterprise managers spend on oversight, streamlining processes, minimizing misclassification risks, lowering costs, and enhancing independent contractor satisfaction.

GATE

Not all independent contractor engagement practices—new or legacy—are created equal. Some businesses, in fact, are pursuing or holding onto independent contractor programs that increase the risk of misclassification or alienating valuable independent talent. It’s critical for today’s business leaders to pursue engagement solutions that not only mitigate compliance risks but also improve program adoption and independent talent re-engagement.

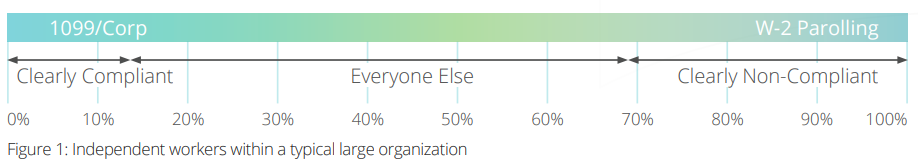

Independent workers range from highly experienced professional services providers to more commoditized temporary workers. As shown in Figure 1 below, they often range significantly in terms of their compliance status.

Figure 1 shows the spectrum across which the typical independent worker may comply with federal and state rules for worker classification.

3 Ways Independent Workers Are Defined

Independent workers are typically defined in three ways:

- CLEARLY COMPLIANT WORKERS:

Enterprises can engage the leftmost group of workers, who are clearly compliant, on a 1099 basis with little risk of reclassification. - CLEARLY NON-COMPLIANT WORKERS:

Workers on the right side of the spectrum are clearly non-compliant. These workers do not see themselves as a true independent business and are generally happy to engage through a traditional payrolling program that provides them with standard W-2 employment status and a regular paycheck. - GRAY ZONE WORKERS:

The compliance status for gray zone workers—the workers who fall in the middle of the spectrum above—may not be easily discernible without further analysis. These workers often see themselves as independent professionals and are unwilling to engage through payrolling programs. This gray zone of independent workers represents the majority of reclassification risk—and is the primary target of compliance and workforce engagement programs.

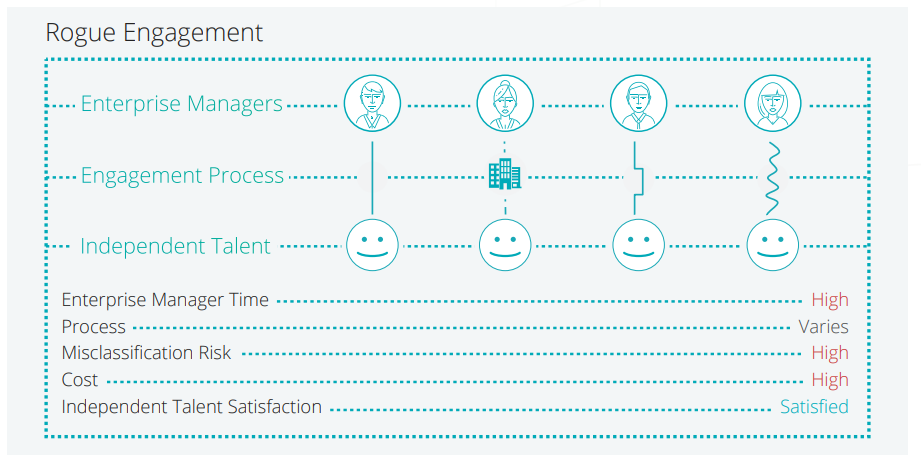

Many businesses today fail to establish engagement policies for independent workers, resulting in the arrangement depicted in Figure 2. In this approach (or lack thereof) independent contractor engagement is typically decentralized across the enterprise and largely managed by the same enterprise managers who are requesting the talent.

1. Rogue Engagement Approach

Many businesses today fail to establish engagement policies for independent workers, resulting in the arrangement depicted in Figure 2. In this approach, or lack thereof, independent contractor engagement is typically decentralized across the enterprise and largely managed by the same enterprise managers who are requesting the talent.

Failing to implement a program for engagement and risk mitigation results in greater misclassification risk, higher costs, and inefficient use of enterprise managers’ time.

Enterprise manager time

In rogue engagement, the enterprise manager works with the independent contractor to create a Statement of Work and get them set up for payment, but the engagement process may vary from manager to manager. This results in a longer time-to-productivity and additional work for the manager.

Process

As a result of a highly discretionary process, rogue engagement leads to inefficiencies and opens the enterprise up to significant risk from misclassification.

Misclassification risk

In most cases, the manager is not fully appraised of the risks of misclassification and treats every worker as a 1099 independent contractor, resulting in a high risk of misclassification.

Independent contractor satisfaction

In rogue engagement, independent contractors are generally satisfied, as they have direct access to the enterprise manager and can complete their project with little interference from corporate procedures and policies.

Cost

As rogue engagement programs are not centrally managed, the enterprise misses out on the opportunity to strategically oversee this spending as a category. This oversight reduces the potential for process improvements and can lead to higher costs. As a result, costs are higher simply because they are not actively managed.

In this approach, enterprises engage a large percentage of their independent workforce—including many potentially non-compliant workers as “qualified” 1099s. Many enterprises believe this engagement decision is justified because the workers are self-incorporated, maintain their own websites, have employees, or have previous experience as independent contractors. However, these qualifiers have little bearing on true regulatory criteria for independent contractor compliance. Consequently, this approach does little to reduce an organization’s risk profile.

2. Restrictive Engagement Approach

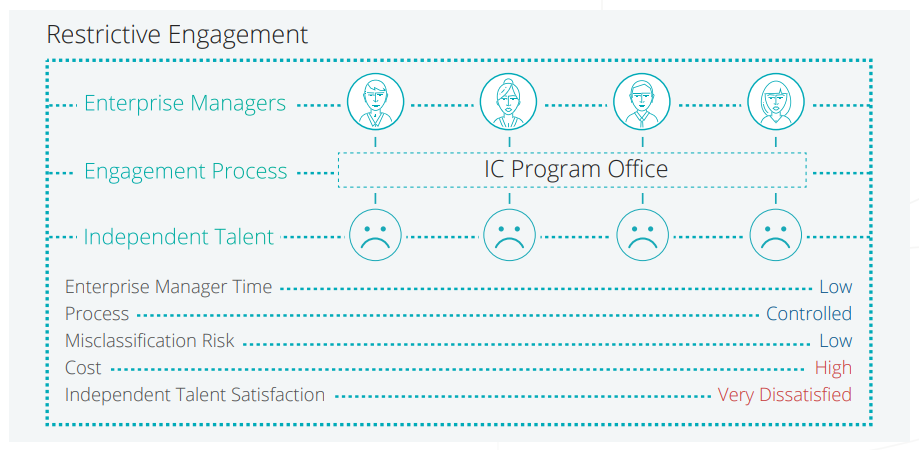

Another common approach is to establish independent contractor engagement policies that place most, if not all, gray zone independents into a traditional payrolling program. This is depicted in Figure 3. In a restrictive engagement approach, the enterprise seeks to centrally manage their independent contractor engagement program, either in-house or through a traditional third-party compliance provider.

Restrictive engagement programs often alienate a large percentage of the independent workforce and lead to even greater talent loss.

Enterprise manager time

Restrictive engagement programs typically leverage a standard workflow, involving a referral process on behalf of managers which does not require a lot of dedicated time on their part.

Process

The enterprise manager will generally refer workers directly to the program office to evaluate compliance risk. If the worker does not meet all the tests and requirements to operate as a 1099 independent contractor, they revert to a W-2 payroll program. This process is more efficient than the rogue engagement approach, as it helps bring spending under management and reduces the risks of misclassification.

Misclassification risk

One benefit of restrictive engagement is that misclassification risks are low since workers are directed into either a 1099 or W-2 payroll program depending on whether or not they meet specified requirements.

Costs

Costs for restrictive engagement programs are high due to the markup of payroll programs which range between 20–40%.

Independent contractor satisfaction

Restrictive engagement programs lead to a high level of dissatisfaction for self-employable talent who view themselves as an independent contractor but may not check every box to qualify. When these professionals are placed into a traditional payroll program, they may be frustrated in their inability to bill on milestones or take advantage of any of the associated tax benefits of working as independent professional.

This approach highlights the common outcome of such payroll-centric compliance programs: a crisis of adoption. Higher-billing workers frequently become averse to these programs and seek out ways to circumvent them or leave their assignments early. Meanwhile, their managers are similarly motivated to sidestep these programs because they are focused on keeping their independent workers happy, even if that means defying corporate engagement policies.

The end result: When program acceptance declines, it results in fewer people actually adopting it. This can lead to talent leaving and an increase in rogue engagements. Additionally, it creates ongoing risks of reclassification and contributes to a lack of visibility in spending.

3. Preferred Engagement Approach

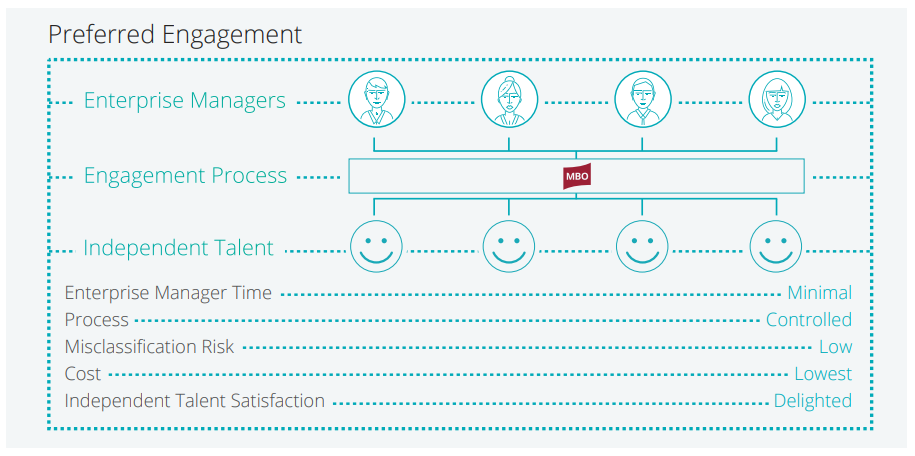

An effective independent contractor compliance and engagement program must achieve two key objectives: mitigating independent contractor risk and ensuring program adoption by both managers and talent. The support and offerings needed by higher-billing independent contractors are often vastly different from those expected by lower-end administrative workers.

Higher-end independent talent value programs which help them establish their own legal structure, provide access to insurance, manage back-office functions, and connect them with future contract opportunities. To successfully and compliantly engage this talent pool, organizations should consider a flexible, consultative solution.

Preferred engagement programs offer workers a variety of engagement options, giving them more choice and adding value to their relationship with their enterprise client.

A preferred engagement program not only offers enterprises greater scale, efficiency, and improved category management, but also seeks to meet the independent talent “where they are” in their journey to become a fully qualified independent contractor. This approach both reduces risk and creates a more talent-friendly approach to engagement. In the preferred program, the worker is provided with more than two engagement options (as depicted in Figure 4), giving them more choice and providing more value in their relationship with their enterprise client.

Enterprise time commitment

In a preferred engagement program, enterprise manager time is kept to a minimum as qualified independent professionals are referred directly to an enrollment site that facilitates worker qualification and onboarding.

Processes

The process for the preferred approach is tightly controlled, thanks to the use of technology that streamlines many complex, time-consuming tasks. A successful independent contractor engagement program includes the processes and technology to identify, source, engage, pay, and manage independent workers effectively. By combining a direct sourcing strategy—identifying candidates for available opportunities using internal resources rather than third-party intermediaries—with technology such as a talent marketplace, organizations can simplify their entire workforce management program.

Misclassification risks

A preferred program recognizes that workers each have different levels of self-employability, as well as individual needs and requirements. Offering flexible and varying engagement options keeps misclassification risk low and helps attract and retain top talent.

Costs

This approach provides a significant cost-savings opportunity for the enterprise as they avoid costly payroll mark-ups, which range from 20-40%. Enterprises also gain an immediate cost benefit from avoiding fines and penalties associated with independent contractor reclassification, including IRS follow-on audits and audits by other federal or state agencies. Down the road, widespread program adoption enables enterprises to realize significant improvements in their visibility into contractor-related spend. Organizations will have a platform upon which they can more easily review enterprise-wide expenditures and control costs by managing rates, supervising budget adherence, and engaging only those contractors whose rates are within established benchmarks.

Independent contractor satisfaction

This talent-centered approach provides products and services which afford independent professionals the opportunity to recognize many of the benefits of working as an independent contractor. For example, in a preferred engagement approach, independent contractors can easily take advantage of tax savings by establishing a pass-through business entity. They also gain access to tax-advantaged benefits including a retirement plan and Health Savings Account (HSA). Additionally, specialists provide support in maintaining a compliant business assisting with quarterly tax estimate requirements and guiding them through their client’s onboarding process to ensure they can start work quickly and compliantly.

Additional Thoughts

Independent contractors bring many benefits to today’s organizations—on-demand expertise, financial savings, and staffing flexibility. As use of this workforce continues to grow, companies must put policies and procedures in place for proper classification, engagement, and management of these workers, especially when bringing higher-billing talent on board.

In this guide

Subscribe to the Insights blog to get weekly insights on the next way of working

Related posts

Learn more about MBO

Learn how to start, run and grow your business with expert insights from MBO Partners

Learn how to find, manage and retain top independent contractors for your projects.

MBO Partners publishes influential reports, cited by government and other major media outlets.

Research and tools designed to uncover insights and develop groundbreaking solutions.