How to Avoid a Worker Misclassification Audit (Guide)

The classification of employees as independent contractors may seem like something that only happens to larger companies, the ones you read about in the news. After all, is the government really interested in the details of how, say, a small business engages freelance writers for website copy? But the truth is that because audits are private, you typically only hear about high-profile cases that involve class action lawsuits.

GATE

The bottom line: Businesses of all sizes and industries can be subject to an audit. As the independent workforce continues to grow, the issue of worker classification has been thrust into the spotlight and audit occurrences are now more frequent.

Our guide outlines the steps to take if your company is audited along with important parts of the process, including:

- General information included in an audit letter, including which records will likely be requested

- Recommendations for how to prepare for the audit, including steps that you and your legal counsel will need to take

- Details on how the audit will be conducted, including expected steps and how to submit required information

We also offer detailed information on the 15 best practices to implement to avoid a misclassification audit.

What It Means to Be Served With an Audit

You receive a notice that your company is being audited for independent contractor misclassification. How did this happen? More importantly, how do you respond? And what protections need to be put in place to ensure that it doesn’t happen again?

Independent contractor misclassification happens to companies of all sizes. Audits are private and, as such, we typically only hear about high-profile cases that involve class action lawsuits. The increased usage of independent contractor talent has led to increased oversight from government agencies on the matter of misclassification.

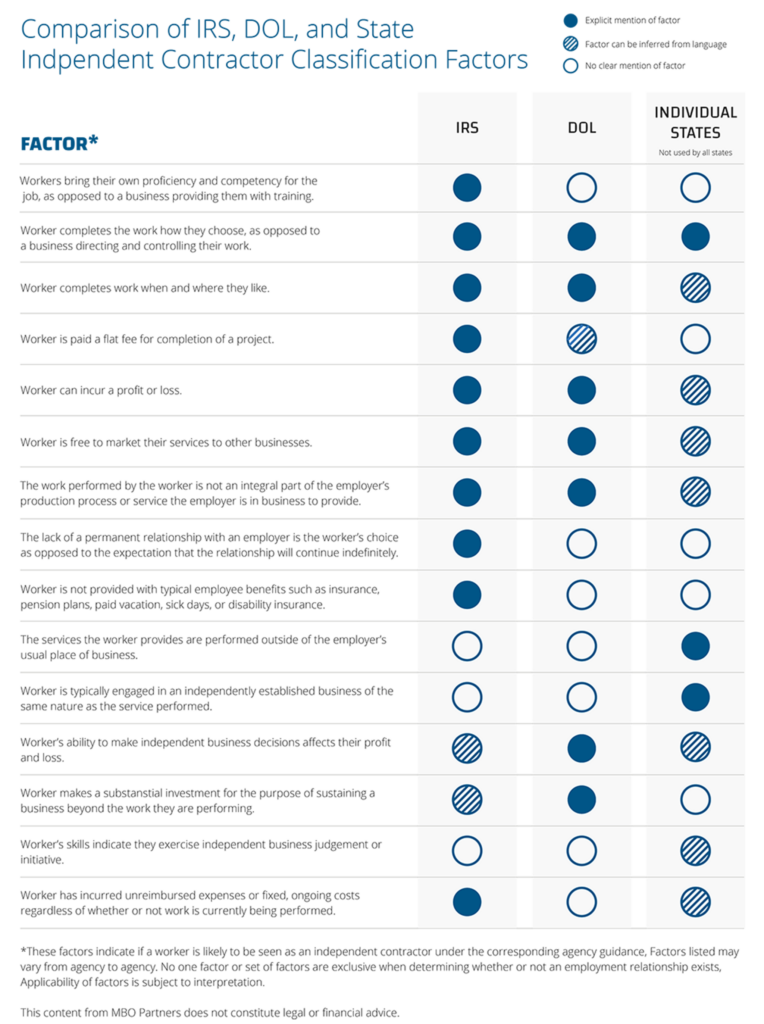

Worker misclassification is complicated, as federal, state, and local government agencies each apply different tests to determine the proper classification of an employee.

Misclassification tests include:

- The Department of Labor (DOL) uses an economic realities test to determine the meaning of “employment relationship” in applying the Fair Labor Standards Act (FLSA). This test focuses on economics rather than technical concepts and examines whether the individual is economically dependent on the business it serves.

- The IRS makes their assessment based on three broad categories—financial control, behavioral control, and type of relationship—with a focus on determining tax liability.

- State laws determine whether an individual is an independent contractor or employee according to their specific workplace laws. Lack of uniformity among these tests means that an individual may be properly classified under one test and improperly under others. While there is no uniform definition of what constitutes an employee versus an independent contractor, one of the most important and common factors is work control. In short, does the employer have the right to control how, when, and where the job is performed?

Other important factors

- The worker’s business: Does the worker in question consider themselves to be a business and offer their services to the market?

- The relationship of parties: How do the worker and the employer perceive their relationship, and how does it appear to the public?

- Economic factors: How is the worker paid, how are expenses handled, and does the worker receive any benefits?

No one factor or set of factors is conclusive. The entire relationship and all its factors must be examined to make an informed decision.

As usage of independent contractor talent has increased in recent years so has heightened security from government agencies regarding the issue of misclassification.

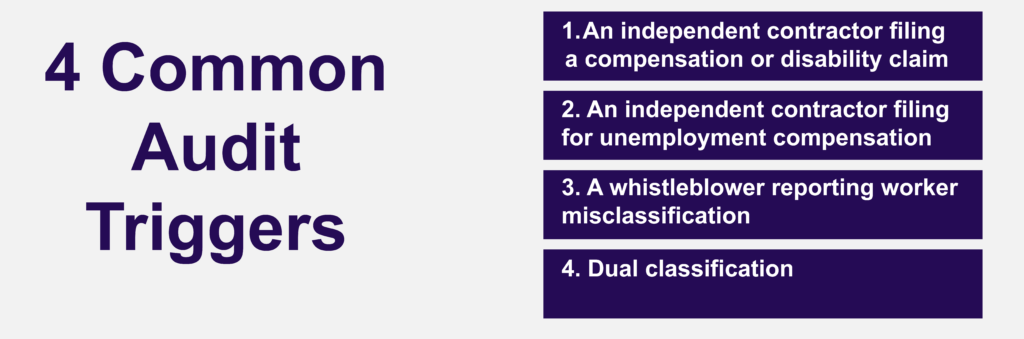

5 Potential Triggers for an Audit

Attorneys, recruiters, and employment professionals are increasingly mindful of the government’s crackdown on the misclassification of employees as independent contractors. Despite the prevalence of this issue, it seems unlikely that it will ever happen to you…until it does. The truth is that any company, regardless of size or industry, can be audited for misclassification. Here are some of the primary factors that may trigger an audit.

1. AN INDEPENDENT CONTRACTOR FILES A WORKERS’ COMPENSATION OR DISABILITY CLAIM

The requirements for workers’ compensation can vary from state to state, with some states considering independent contractors as employees under their workers’ compensation law. For example: In 2010, the New York State Construction Industry Fair Play Act was signed into law and amended the Labor Law and the Workers’ Compensation Law to establish a presumption of employment in the construction industry. This makes it imperative to understand state laws and requirements so you can ensure that contractors are compliant as well.

2. AN INDEPENDENT CONTRACTOR FILES FOR UNEMPLOYMENT COMPENSATION BENEFITS

When an independent contractor files for benefits, the claim is evaluated and can trigger an audit. Because independent contractors are not employees, they are ineligible for unemployment compensation. However, if the individual in question is found to have been misclassified as an independent contractor, they can be reclassified and may be entitled to unemployment compensation and retroactive benefits specific to traditional employees.

3. A WHISTLEBLOWER REPORTS MISCLASSIFICATION

An independent contractor can notify the IRS if they believe themselves to be wrongly classified. The IRS requires that whistleblowers provide solid and specific information. If the information leads to an action such as investigation, judgment, or collection, the whistleblower (in this case the independent contractor) could qualify for an award, which may be up to 30% of the taxes and penalties the IRS collects.

An independent contractor who feels they have been improperly classified can file a Form SS-8 with the IRS for their own classification determination. Or they may also file a Form 8918, Uncollected Social Security Tax and Medicare Tax on Wages, with their personal income tax return.

4. DUAL CLASSIFICATION IN THE SAME TAX YEAR

A worker who receives both a W-2 and a 1099 from an employer in one year can trigger an audit. This may happen when you engage an independent contractor as a traditional employee. If the employee performed the same work, the IRS may wonder why they were not classified as an employee all along. While this raises the risk of a misclassification audit, there are certain instances where you would treat a worker as both an independent contractor and a traditional employee in a single tax year. For instance: In a 2007 case, a radio host and program director who performed side work finding and working with sponsors was found to meet the dual classification test (Ramirez v. Commissioner; May 20, 2013).

5. HIGH-RISK INDUSTRY

The IRS, DOL, or a state unemployment agency often selects companies in high-risk industries for audits. In fact, some industries such as construction, food and beverage, and field service technical support experience a greater frequency of audits. Operating in one of these industries could increase your exposure to audits.

Key Details of an Audit

No company wants to be audited, but if you are, it’s important to cooperate with the auditor to the fullest extent. You can do so by understanding what happens in an audit and how to prepare.

The audit letter will typically contain the following:

- Period covered by audit

- Scope of records to be reviewed

- Specific entity being audited

The agency will also request specific records such as:

- 1099s

- Checks, cash payment records, and bank statements

- Tax reports and income tax returns

- Payroll records

- Financial statements

- List of the corporation’s officers and related corporate entities

Audit letters will generally not have much detail. However, you can ask for specificity and the auditing agency will be required to provide it. Overall, it’s important to put parameters around what will be covered.

Understanding what happens during an audit can help you be prepared and achieve the best possible outcome.

Preparing for the Audit

To prepare for the audit, review and work through the following steps:

- Appoint an internal audit team with representatives from legal, HR, payroll, tax, and outside counsel.

- Schedule a conference call with the auditor. You may also want to schedule subsequent conference calls so you can narrow the scope of the investigation. The auditor will typically ask for all 1099s for a three-year period. If the volume is large, they may select a random sample of 1099s from each year or simply perform a spot check.

- Determine the audit period so that you can focus your information gathering and resources accordingly.

- Limit the scope of the audit. While an audit initiated by a claim might cover a wide range, you have the option to narrow its focus. You can focus your response on one particular individual, group, or segment.

- Determine what triggered the audit. This not only helps in preparing for the audit but in preventing future problems.

- Separate Employee Identification Numbers (EINs) from Social Security Numbers (SSNs).

- Focus your audit preparation solely around 1099s.

- Flag any situations where a contractor received both a W-2 and 1099 in the same or consecutive tax years.

- Consider setting aside reserves and issuing a litigation hold.

Your legal representation will also do the following in advance of the audit:

- Obtain background information by interviewing department heads and managers.

- Determine the contractor’s role and responsibilities or a description of the services they rendered.

- Assess if the independent contractor was properly classified, which may include:

- Reviewing contracts, invoices, and any other documents that support independent contractor status.

- Reviewing the contractor’s website and advertisements.

- Reviewing the contractor’s list of clients. Gather as much detail as possible about the working relationship between your organization and the contractor.

- If possible, group all the individuals involved in the audit by categories.

- Determine if the contractor’s services are or were also performed by traditional W-2 employees and, if so, focus on the differences.

Your legal counsel may review your records for prior audits and their outcomes. They will also identify if there are similarities that triggered the audit and consider any fraud or penalty issues.

Conducting the Audit

The auditor may want to schedule an on-site visit, but you can suggest that meetings be held in a neutral location such as the offices of your outside legal counsel. If possible, send documents to the auditor after the request has been made—submit your most defensible cases to the auditor first. You can also schedule a meeting with the auditor to review any borderline or difficult cases. It’s critical to provide an honest assessment where misclassification is obvious or where you are unable to defend the 1099 classification.

Resolving the Audit

If applicable, negotiate your settlement amount as well as any fines or penalties that may be assessed. When you submit your settlement check to the agency, be certain to reserve all rights and indicate that you are not admitting liability for misclassifications.

Next, you’ll want to make voluntary changes to your process for engaging and managing independent contractors. This could include revamping your internal documented process or partnering with third party vendors who can manage this process for you. It might also be beneficial to reclassify certain workers.

Consequences of the Audit

Misclassification can be disruptive and expensive.

The potential consequences include:

- Responsibility for back pay and liquidated damages

- Having to pay back taxes, interest, and penalties

- Paying Social Security and FICA

- Disqualification of company benefit plans

- Liability for overtime, meal periods, PTO, leave periods, and rest breaks

- Contractors may claim 401(k), severance, health or welfare coverage, or employee stock purchase plans

- Criminal and civil penalties and sanctions

- Additional contributions to unemployment compensation and workers’ compensation funds

15 Steps to Avoid an Audit

If you are audited, take the opportunity to refine your process for engaging independent contractors while minimizing the risks of misclassification.

Follow these 15 steps to put a better process in place for engaging and managing independent contractors.

- Develop guidelines for hiring and managing independent contractors. Work with your HR team and hiring managers to get input on the process. Ultimately, you’ll want to develop policies that are consistently enforced.

- Consider written policy changes as applicable. Your policies should ensure compliance without compromising your ability to do business. Be willing to review and update your guidelines as needed.

- Update your hiring and contractor engagement procedures so that going forward, contractors are properly classified.

- Conduct your own internal audit and investigate current classification practices.

- Have a detailed description of the services performed by contractors for your records.

- Ensure that the contractors you engage qualify as independent:

a. Research contractors on your own to ensure that they have other clients and are advertising their services to the public.

b. Require all contractors to obtain a federal tax ID number. - Have a written contract when engaging independent contractors. Make sure that each ofyour hiring managers understand this as well. It’s important to verify that your standard contract includes provisions specifying that contractors are free from control, that they have insurance, and that they can hire their own employees.

- Have a check and balance with Accounts Payable to ensure that a contract is in place before paying a contractor invoice.

- Avoid having contractors use your office or company equipment.

- Refrain from engaging independent contractors to perform the same type of service as an employee or former employee of the company. This does not mean you cannot engage independent contractors for overflow or to support staff on special projects.

- Do not have contractors submit timecards. Independent contractors should submit an invoice for payment based on the terms of your agreement.

- Don’t reengage a former employee as an independent contractor to perform the same services.

- Be mindful of co-employment. Co-employment, or joint employment, occurs when two companies both have rights and obligations as an employer. This commonly happens when staffing agencies hire independent contractors for their clients. Co-employment can increase the risk of litigation when a contractor thinks they have been misclassified—or if your company is audited and found to have treated contractors as employees, and vice versa.

- Form an internal team to manage your compliance efforts. A cross-functional team that includes legal, compliance, human resources, and procurement can help you to address any red flags before they become bigger issues.

- Partner with a company that specializes in independent contractor engagement and compliance.

Additional Thoughts

Independent contractors can be a vital resource for your company and are increasingly becoming an integral part of doing business. You can minimize the risk of a misclassification audit by implementing and consistently enforcing a standardized process for engaging and managing independent contractors.

In this guide

Subscribe to the Insights blog to get weekly insights on the next way of working

Related posts

Learn more about MBO

Learn how to start, run and grow your business with expert insights from MBO Partners

Learn how to find, manage and retain top independent contractors for your projects.

MBO Partners publishes influential reports, cited by government and other major media outlets.

Research and tools designed to uncover insights and develop groundbreaking solutions.