Modernizing Business Models to Manage Risk is as Old as The Dutch East India Company

Uncertainty causing boards and managements to change the business is as old as the public company itself. If we look to history as an example, the creation of the first publicly listed company in the world was the result of investors and management modernizing the business structure to manage uncertainty—the same situation we are facing today as a result of COVID-19. The Dutch East India Company, also known as the VOC, was created in 1602. As the first modern publicly traded company, it was a revolutionary idea at the time. Previously, investors financed individual trade journeys by merchants, and hoped to regain their investment on the cargo the merchants brought home. But this brought significant risk—from disease to piracy to bad weather, there were many reasons a journey could fail. Further risk awaited once on shore. If the cargo made it home, investors gambled that the value of the cargo on the open market would be as strong as they anticipated. To reduce the risk for investors, and thereby reduce the cost of capital, a solution was proposed. Investors and merchants would pool their investment in one company, which would grant all investors, both active business participants and passive investors alike, limited liability through the fractionalization of the capital structure. This fractionalization created liquidity for investors that simply did not previously exist. If investors wanted to get out of their investment, they couldn’t force the company to buy them out—instead they would need to sell their interest. The Amsterdam Stock Exchange was created expressly for this purpose. The company could finance multiple expeditions and manage the volume of spices and other goods that were sold over time, effectively managing both supply and demand. Thanks to the fractionalized structure, the company as a whole had greater flexibility and control over their destiny.

What COVID-19 and the Dutch East India Company Have in Common

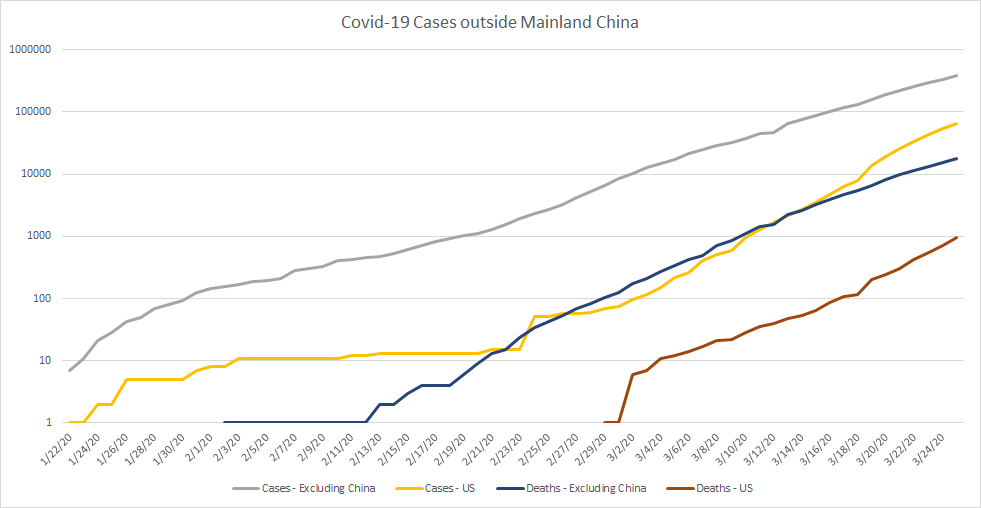

The economic impacts of COVID-19 are far-reaching and well beyond the short term—particularly as coronavirus cases outside of mainland China expand exponentially day by day, locking down entire nations and resulting in an unprecedented travel ban from continental Europe that takes effect this evening. With more than three decades of experience seeing, taking, and managing risk while building businesses, I have learned it is helpful to focus on data that provides context around trends and sharp changes in trends. As it relates to COVID-19, the growth of cases excluding mainland China is a key trend to watch.

Note the log scale and consistency of the trendline. Cases will continue to rise, and the situation will likely worsen before it improves, but it almost certainly will improve. The current situation is not unlike a failed merchant voyage prior to the creation of the Dutch East India Company. An organization likely can withstand a few bad weeks or even a few bad quarters, but while the pandemic continues, organizations will need to act nimbly, strategically leveraging their workforces to take full advantage of rapidly changing business models. The scope and scale of COVID-19 is uncertain. There are lots of opinions, some informed and many less so. But one thing is for certain: the impact will range far beyond the physical impacts on humans.

A Modern Business Model Can Help Organizations Thrive in Times of Accelerating Change

Today’s modern business models have the opportunity to leverage these lessons with a critical resource—human capital—by taking advantage of flexible and efficient access to critical assets in the form of independent professionals. Most savvy business leaders agree that their most valuable asset is their people. But in the case of traditional workforces, those full-time employees are also a burden when work halts, slows or otherwise demonstrates an unpredictable change as a result of external forces, such as economic downturn or epidemic, as demonstrated by the current coronavirus outbreak. The first strategic pivot is an immediate risk mitigation strategy in the form of physical containment, such as travel bans and mandatory remote work arrangements. With fears of COVID-19 spread rampant, many organizations, including Facebook, Microsoft and Amazon have implemented mandatory “work from home” policies, particularly in hard-hit areas. This is not intended to be “yelling fire in a crowded theater,” rather intended to take an abundance of caution in protecting not only your business but your most important asset… your talent. But even in the best cases of a mandatory remote work shift, workers will scramble—to find childcare, to manage new policies, and to keep up with the current pace in a new and ever-changing environment. Even the best full-time talent is not enough in cases of rapid change. To stay on track, modern businesses could turn to the lessons of the Dutch East India Company and consider fractionalizing to mitigate risk. Today, 41 million Americans work independently, ranging from workers who supplement their incomes with side hustles to 15.3 million who work full-time as self-employed professionals. Independents work across ages, genders, and skill sets, in all major industries, including highly in-demand areas like software development, artificial intelligence, and engineering. According to the State of Independence, more than 8 in 10 workers work remotely at least some of the time and 37 percent work remotely full time. These numbers are even greater amongst independent workers.

Close the office? Not a problem–your independent workers are already used to remote meetings, managing flexible schedules, and fast-changing priorities.

COVID-19 is a perfect example of how a well-articulated independent workforce strategy could help organizations stay not just afloat, but ahead of the next wave of change. Many in-demand professionals work independently as change management consultants, in supply chain practices, or specialize in responses to crisis situations. If this talent is already in your network, engaging them for projects is simple and efficient, a perfect example, much like the Dutch East India Company, of managing supply and releasing in times of high demand. These workers can be used both consultatively alongside the traditional workforce, but also in tandem with offshore resources as front-line and tactical project supplements in times of heavy demand. This is not a new trend; 65 percent of executives say that the external workforce is important or very important to operating at full capacity and meeting market demands, and 68 percent say it is critical to developing or improving products and services. The question today is not “is your organization using independent workers” but “is your organization using independent workers successfully and as part of a long-term strategy?” Unfortunately for many businesses I speak with, the answer is somewhere between “no” and “I don’t know”. Too often, management of external workforces is delegated to procurement managers sitting somewhere in middle management and not discussed at the executive and board level. So why are some organizations treating external talent with a transactional lens, rather than as a strategic asset? My company, MBO Partners, has been in the business of enabling independent professionals for more than two decades. Its platform offers an end-to-end ecosystem to enable independent professionals and enterprises to work together efficiently and compliantly. But the platform itself is not enough to guarantee success in a modern business model, just like the ships of the Dutch East India Company—no matter how well-captained, how well-waterproofed, or how smartly-stocked, no one could predict or guarantee a perfect journey, each and every time. Voyages, like people, are unpredictable and need human oversight to help plan for success and to change course in the case of contingencies, crises and that other big c, COVID-19. Organizations must simultaneously forecast and plan for a future where a modern business model includes articulating and adopting a workforce optimization strategy that is owned by executive management and embraced by the board, leveraging independent professionals, offshore talent and traditional workers alike as strategic assets in a future growth model. In today’s environment, these strategies are both necessary and possible. They are part of both a future growth model and a risk mitigation plan alike. Change catalysts can be good or bad. In this case, the lessons of the past show us that those organizations that are best prepared now for the future are also best equipped to pivot and weather whatever storms await on the horizon.

Want to discuss further? Drop me a line – miles.everson@mbopartners.com. I’m happy to chat.

About Miles Everson, CEO of MBO Partners:

Miles Everson joined MBO Partners in 2019 as Chief Executive Officer. Most recently, Everson served as Global Advisory and Consulting CEO for Pricewaterhouse Coopers, LLP (PwC), leading the company’s Asia Pacific Americas Advisory and Consulting businesses. Before joining MBO, Everson had a rich career with PwC, almost three decades in total. He began in the firm’s Assurance practice, moving to leadership roles within Advisory/Consulting in both Canada and the U.S., including several Financial Services leadership roles, and eventually became the U.S. Advisory/Consulting Vice Chairman.

Categories

Subscribe to the Insights blog to get weekly insights on the next way of working

Source, engage, and manage high value talent through MBO marketplace

Learn more about MBO

Learn how to start, run and grow your business with expert insights from MBO Partners

Learn how to find, manage and retain top-tier independent talent for your independent workforce.

MBO Partners publishes influential reports, cited by government and other major media outlets.

Research and tools designed to uncover insights and develop groundbreaking solutions.